Park 64 Capital Blog

Thanks for stopping by and checking out our blog. We post interesting things about finance that we think are of use to the general public, but you should never interpret anything on our website to be financial advice.

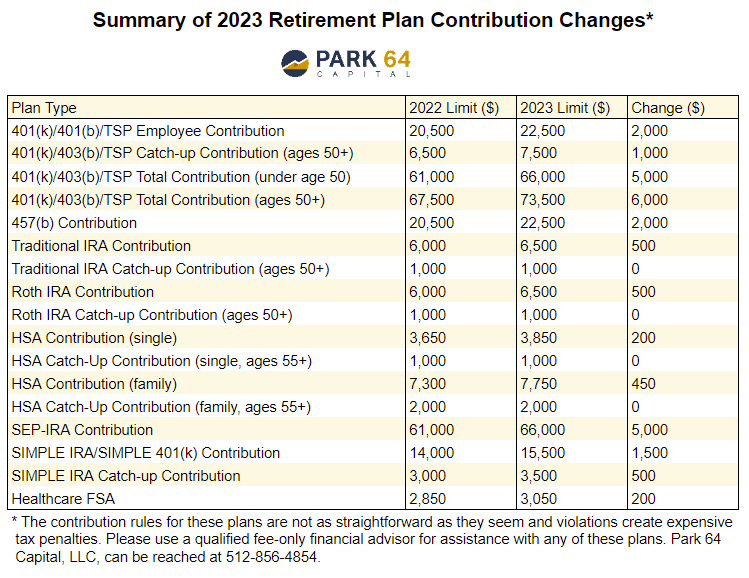

2023 Retirement Plan Contribution Limits

This post contains the 2023 contribution limits for 401(k), 403(b), IRA, HSA, FSA, SIMPLE IRA, and SEP IRA plans

Inflation has been hovering north of 7% for the entirety of 2022, which has given the IRS leeway to increase the limits for some of the most common retirement plans in 2023: 401(k)s, 403(b)s, TSPs, 457(b)s, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs. Unlike 2022, the IRS actually did increase the Traditional IRA and Roth IRA contribution limits in 2023. The announcement for qualified plans was made official by the IRS in Notice 2022-55. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2023 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $20,500 in 2022 to $22,500 in 2023.

The catch-up contribution for those ages 50 and older has increased from $6,500 in 2022 to $7,500 in 2023, which means employees ages 50 and older can contribute up to $30,000 in 2023.

2023 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $61,000 in 2022 to $66,000 in 2023.

For those ages 50 and older, if you include the catch-up contribution, the limit is $73,500.

2023 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $20,500 in 2022 to $22,500 in 2023. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older increased from $6,500 in 2022 to $7,500 in 2023; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2023 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs has increased from $6,000 in 2022 to $6,500 in 2023.

The catch-up provision for those ages 50 and older remains at $1,000 in 2023.

2023 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2023.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2022): $68,000-$78,000

Single (2023): $73,000-$83,000

Married Filing Jointly (2022): $109,000-$129,00

Married Filing Jointly (2023): $116,000-$136,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2022: 204,000-$214,000

2023: 218,000-$228,000

2023 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2022): $129,000-$144,000

Single and Head of Household (2023): $138,000-$153,000

Married Filing Jointly (2022): $204,000-$214,000

Married Filing Jointly (2023): $218,000-$228,000

2023 Health Savings Account (HSA) Contribution Limits

The single contribution limits for HSA plans has increased from $3,650 in 2022 to $3,850 in 2023.

The family contribution limits for HSA plans has increased from $7,300 in 2022 to $7,750 in 2023.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2023. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2023 Flexible Spending Account (FSA) Contribution Limits

The 2023 healthcare FSA contribution limit has increased from $2,850 in 2022 to $3,050 in 2023.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2023 SEP IRA Contribution Limits

The SEP IRA limit has increased from $61,000 in 2022 to $66,000 in 2023. Remember, SEP IRA contributions can only be made by the employer.

2023 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limit has increased from 14,000 in 2022 to $15,500 in 2023.

The SIMPLE IRA catch-up contribution has increased from $3,000 in 2022 to $3,500 in 2023.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

Why Stock Prices Go Up and How to Make Great Investments

This post explains why stock prices change and how to be a great investor.

People as a whole are poor capital allocators. Being a cutting-edge neurosurgeon, a brilliant CPA, or a savvy programmer does not provide the skillset required to be long-term successful in markets. What does then? Before we dig into that, we need to first understand why stocks go up in the first place. On the surface, this feels like an extremely complicated question, and you may even be wondering if I’m trying to trick you. No tricks today. The answer is surprisingly simple:

Stock prices go up when there are more buyers than sellers.

Stock prices go down when there are more sellers than buyers.

Valuation, growth prospects, profitability, and the macro environment are nothing more than signals to bring buyers and sellers to the market. Ostensibly, not all signals are corresponded to rationally; for example, a fantastic earnings report may result in a stock price decline. Why would people sell off a company who posted strong results?! It might surprise you to know that stocks trade based on what is expected to happen in the future, so the alignment of earnings against expectations is what ultimately matters. When future expectations are used as the yardstick for pegging stock prices, short-term volatility is a corollary.

If you knew which days buyers were going to outnumber sellers, you’d have found the holy grail to stock market investing; you’d make money on every trade! It suffices to say that many have tried to build analytical models and systems to predict market direction. Unfortunately, those systems tend to work until they don’t. There are too many variables involved, including emotions themselves, that incentivize people to buy and sell securities. Market prediction mechanisms are more apt to lull an investor into a false sense of security than create meaningful and consistent profits.

The randomness of stock price movements is referred to as Brownian motion. The classic example of Brownian motion is dropping a single bead of food coloring into water and trying to predict where it will go. Hot and cold water, much like the macro environment, will impact the rate of movement, but the actual movement is inherently random.

Brownian motion at work

If markets are indeed random, what odds does that leave for an investor who is trying to build a retirement portfolio? If, after all, stock trading is nothing more than spinning a roulette wheel each day, why not build your retirement at the casino? The truth of the matter is that all short-term movements in the stock market are random, but long-term movements, while still having many unknowns, are much more predictable if you know how to do the proper analysis. Analysis is complex, imperfect, and can be summarized as the act of increasing sets of known information while reducing sets of unknown information until a conclusion regarding an investment can be reached.

Earlier, I mentioned that most people are not successful in making money in markets over the long-term. This is because most people are either traders or other ill-equipped investors. Let’s take a quick look at the difference between a trader and an investor to better understand why.

Trading vs. Investing

These two words get mixed up a lot and in most situations, they can be used interchangeably without any need for correction. But it’s important to differentiate trading from investing for the intents and purposes of this entry.

Trading: Placing a bet on a stock

Investing: Placing a well-educated bet on a stock

Notably though, not all investments are long-term and not all trades are short-term. A trader is making a decision based on emotions, prior price movements, or an idea that lacks sound qualitative and/or quantitative fundamental reasoning. A key difference in investment is the research of various imperatives to determine that there is a substantial chance for material gain relative to material loss; I like to call this differential the asymmetric upside of an opportunity. Proper research also provides the right framework to make better decisions as more information becomes available over time. While even the best investors are occasionally wrong, the successful ones are good not only at making money but also at not losing it. Furthermore, an investor can tolerate a position moving against them for a very long time, assuming the underlying reason for investment has not changed and another more appealing, alternative opportunity has not come onto the scene.

Think of the difference between trading and investing like the difference between Blackjack (trading) and Poker (investing).

In Blackjack, you start every hand with zero information and are simply wagering what you think you can afford to lose; the odds are stacked against you. The dealer will even help you make better decisions, and the drinks may soon become free. Just like your stock broker who wants to keep you trading, the casino wants to keep you playing. Any short-term success will eventually succumb to the inevitability of probable losses if you stick around for long enough. The bid-ask spreads also rack up in trading, a common complaint among those who advocate against selling order flow.

In Poker, on the other hand, each hand brings a series of knowns and unknowns, and you can immediately fold your hand at minimal investment. There are an incredible amount of datapoints that emerge throughout each hand: cards, player styles, bluffs, probabilities, bet sizes, etc. This puts you in the driver seat, allowing you to make bigger bets when the odds are in your favor; and perhaps more importantly, to cut your losses when the status quo becomes unfavorable. And no matter how good you are at Poker or investment, you may still lose even when the odds to win are heavily in your favor, something Poker players call a bad beat.

There are still two grey areas in the differentiation of a trader and an investor:

Time: If a trader holds a poorly researched position for years, are they an investor by fiat?

Sufficiency: How much information must one have to support a position to be considered an investor vs a gambler?

The nuance begged by the above two questions probably doesn’t even matter; those who hold poorly researched positions, even over a long time horizon, are going to make more human judgment errors, resulting in suboptimal asset accumulation over extended periods of time.

How to Be a Successful Investor

Being an above-board investor is incredibly difficult because it requires a massive time commitment to do things that most would consider extremely boring. As mentioned earlier, an investment skillset is very similar to that of a Poker player: long hours of grinding away until the right opportunity strikes; then, careful movement in and out of it. When done this way, long-term stock market success becomes much more predictable; of course, short-term movements are still random, and no market participant wins every single time; therefore, the investor is burdened with sizing his positions accordingly.

The skills to be a superb investor are difficult to define, but here are some of the more basic requirements:

Know the goals of your portfolio. You can’t allocate if you don’t know what you’re targeting.

Look for ideas everywhere. Every 100 ideas probably only has 1 or 2 good leads.

Read the stock’s respective SEC 10-K and 10-Q and have a fundamental understanding of income statement, balance sheets, and cash flows analysis.

New information can’t be ignored. Risk/return trade-offs can change in an instant.

Having exit criteria going in is important; otherwise, how do you know when to increase your bet or cut your losses?

Know how to size your bets. I’ll post another article on this later, but this is a major differentiator between good and bad investors. It’s more mathematical than you might think!

Leveraging an experienced and talented investment advisor can give you instant access to a propitious long-term portfolio without having to commit time and energy to learning a skillset that takes years of careful study to develop with no guarantee of having the knack for it. Pairing with an advisor is one of the best ways to make the most of your career earnings. Unfortunately, most people tend to delay the process until later in life, which subsequently delays their retirement goals.

Your Economics Teacher Gaslighted You, and Why Inflation Keeps Increasing

Inflation is red hot. This is why.

October 2022 - The U.S. economy is in a recession: two consecutive quarters of declining GDP are all that is required.

In a recession, we typically see a decline in interest rates and inflation rates. Ironically, we are seeing the exact opposite:

August 2022, inflation: 8.30%, from 1.30% two years ago

September 2022, 30-year mortgage: 7.00%, from 3.00% two years ago

September 2022, 10-year treasury: 3.80%, from 0.75% two years ago

If you’re confused about why America and the rest of the world is in such a flux right now, you’re not alone. We can’t merely blame Covid, Russia, or China either. While there is some part to be played by globally impactful events, there is another key reason that America seems to be flipped over on her head.

Inflation as of August 2022

How the Economy Works: 101

The economy cycles from expansion to contraction. Think of this like state changes over time that range from very good to very bad. Not all expansions are exuberant and not all contractions are painful. The year 2022 is one of those notable contractions that is very painful.

During expansion:

During expansion, things are great! You don’t hear many complaints from your neighbor, and everyone seems to be winning on all fronts: employment is high, housing markets are extremely competitive, stock markets seem to give free money, and startups grow like weeds.

Generally speaking, in expansionary economies:

Businesses grow - because there is money for the taking

Interest rates rise - because corporations are demanding more investment dollars

Jobs are created - because corporations need more labor

Spending rises - because people have more money

Inflation rises - because demand for goods and services increases

During contraction:

We all know that people tend to go too far and then overcorrect, so it goes without saying that all expansions come to an end in some fashion. During a contraction, consumer spending growth slows and consumer savings start to rise as interest rates become more attractive. As a corollary, production falters as demand for products declines.

Contractions are easy to spot — when you start to hear stories on the news about people losing their jobs and not being able to buy their kids tons of Christmas presents, you’re in a contraction.

Generally speaking, in contractionary economies:

Businesses decline- because there aren’t enough additional profits to justify expenditures

Interest rates fall - because corporations aren’t demanding dollars to grow

Jobs are lost - because companies don’t need the extra labor anymore

Spending declines - because people have less money

Inflation falls - because demand for goods and services decreases

Why interest rates fall during contraction:

In a free market economy, interest rates should fall when corporations are becoming more hesitant to borrow (i.e. sell bonds) due to a glut of either inventory or labor or both. As a corporation’s desire to borrow decreases, so does the interest rate they’re willing to pay to do so. This interest rate lowering affect usually begins at the peak of an expansionary period and signals a contraction on the horizon.

Did Your Economics Teacher Gaslight You?

While we can say that America is in a recession from a technical definition, does it really feel that way? There is only a slight increase in unemployment (left graph below) and the number of workers is still growing (right graph below). We are starting to see some layoffs and hiring freezes, notably at certain big tech firms such as Facebook; yet, decent jobs can still be found with reasonable effort.

According to theory, a contracting economy brings job losses, declines in spending, declines in interest rates, and declines in inflation. But as of October 2022, we’re seeing increasing interest and inflation rates paired with a stalled out, or arguably declining, economy.

So is economic theory just a pack of lies your former teacher told you to sound smart, or is there any hint of truth to it? To understand why increasing interest and inflation rates can coexist in a stagnant economy, let’s take a hard look at the most powerful market manipulator of the 21st century: the Federal Reserve Board.

The Federal Reserve Board is Killing Your 401(k)

From 2008-2021, the Federal Reserve Board (the FED) has been working in conjunction with the United States Treasury to increase the money supply, a process called quantitative easing (QE). During QE, the Federal Reserve Board purchases government bonds from banks. This has a stimulatory effect on the economy because it increases the banks’ reserves and therefore makes it easier for those banks to lend at more favorable terms, resulting in the growth and expansion of American businesses. While QE is useful to stimulate an otherwise declining or stagnant economy, it is a powerful tool that flies in the face of a free market economy.

Money supply in America

During QE:

The FED is lending to the economy - this is stimulatory

Stock prices rise - because businesses can grow so much more when money is cheap

Bond prices rise - because the FED adds to bond demand

Interest rates fall - because the FED is such a willing lender, the banks can pay lower interest rates

By manipulating interest rates to artificially low levels, the FED never allowed the U.S. to recover organically from the 2008 market crash. The FED essentially propped up American businesses with free money, so the true market rate of interest could not be found. It has done this over and over again from 2008 to 2022. In March of 2020, for example, the FED increased its asset purchases by $1.50 trillion and then added another $500 billion four days later.

The good part about QE is that it allows the economy to grow and expand to levels it otherwise couldn’t, much like an athlete taking anabolic steroids. However, the downside is that inflation will eventually run rampant because people have too much money to spend. The FED had historically navigated the inflation issue well and kept it stable from 2008-2021. But it’s very tenable that the downstream effects of Covid lockdowns were the straw that broke the camel’s back.

Now, in 2022, the FED has removed its support of the QE program to thwart inflation. It is instead selling government bonds back to banks, a process called quantitative tightening (QT). In QT, interest rates rise because the FED is flooding the market with a newfound demand for dollars. QT increases interest rates and simultaneously pulls money out of the system. The idea here is that by increasing interest rates via QT, stock markets will crash, home prices will fall, and eventually people will stop spending money; inflation should decrease as a corrolary.

During QT:

The FED is borrowing from the economy - this is dampening

Stock prices fall - because businesses can’t grow as quickly when money is in short supply

Bond prices fall - because the FED is selling off the government bonds it previously purchased

Interest rates rise - because the FED is such a willing borrower, the banks can charge higher interest rates

What about Inflation?

The strange part about all this, again, is that expansions should bring about rising inflation, which should naturally bring about higher interest rates until, at some point, the contractionary cycle should begin. But because the FED has been laying on the economic gas pedal in the form of QE for so long, interest and inflation rates are rising in the face of the 2022 economic slowdown, which creates an even more harmful contraction.

It’s worthy to note that this contractionary cycle was inevitable; it was a always a question of “when” not “if.”

Think of the economy like a pendulum. If you swing too far in the direction of QE, the pain of QT is going to feel even worse.

What Next?

It’s very likely that America is in for a bit more economic trouble over these next couple of years as QT runs its course. But trying to guess what the FED will do next is a fool’s errand; therefore, it’s still a good idea to stay long-term oriented with your financial plans and investment portfolio.

At some unknown point, the process of QE will likely begin again, creating another spectacular growth period in America. Or, perhaps the Federal Reserve Board will learn its lesson and retire the QE program altogether, letting the free market decide the appropriate interest rates to pay.

Only the future will tell, and it’s very uncertain.

Disadvantages of the Roth IRA

This post discusses the disadvantages of the Roth IRA, a popular retirement savings vehicle.

Since their inception in 1998, Roth IRAs have exploded in popularity. Roth IRAs offer tax-deferred investment growth as well as tax-free distributions, provided you meet certain eligibility requirements. In addition, there are no RMDs on Roth IRA accumulations, so you can hold the account value for life, making it a meaningful part of your estate planning strategy.

While the advantages of a Roth IRA are more easily understood and promoted, the disadvantages are rarely discussed. Not all of these downsides are dealbreakers, but they are high on any financial advisor’s list when thinking about how a Roth IRA fits into the context of the wholistic planning strategy for an individual or family. It’s worth noting upfront that the value of a Roth IRA is unlocked only when you make money in the account. If you lose money over the long-term, you’d have been better off in a taxable brokerage account.

Downsides to the Roth IRA

A Roth IRA has a number of disadvantages:

Contributions are not tax deductible

Contribution and income limitations

No capital loss deductions

Complicated distribution rules

Early distribution taxation

10% Penalty taxation

Disadvantage #1: Contributions are not tax deductible

Roth IRA contributions are not tax deductible, so you won’t reduce your income taxes by funding one. Compared to a Traditional 401(k) contribution at an identical savings target, you’ll have less cashflow due to the income tax burden. The higher marginal tax bracket you’re in, the more taxes you’ll pay upfront by foregoing a Traditional 401(k) for a Roth IRA.

Disadvantage #2: Income Limitations

For 2022, you can only put $6,000 into a Roth IRA (or $7,000 if you’re at least age 50). In addition, Roth IRAs have maximum Modified Adjusted Gross Income (MAGI) limitations, which are discussed here. If you make more than the upper end of the Roth IRA MAGI limit, you can’t contribute to a Roth IRA.

There is a technique called a Backdoor Roth IRA that allows you to circumvent the MAGI limitations; however, it requires the care and skill of a professional to avoid violating the IRS’ Step Transaction Doctrine. The Step Transaction Doctrine basically says if you take a series of steps to get to the same result as you would have gotten with a single transaction, you’ve effectively made the single transaction.

Disadvantage #3: No Capital Loss Deductions

The IRS lets you annually deduct up to $3,000 of net capital losses against your other income for the year, where any excess beyond $3,000 can be carried forward to the next tax year. This deduction is an above-the-line deduction, making it even more valuable. But losses in a Roth IRA do not receive this tax treatment.

There is one exception to this rule. If you close all of your Roth IRAs, you can report any aggregate loss on the total basis as an itemized deduction on Schedule A. I’ve never heard of anyone ever doing this, but it does technically exist.

Disadvantage #4: Complicated Distribution Rules

Distributions from a Roth IRA are assumed to be taken in the following order:

Contributions first

Conversions second

Growth third

Having contributions come out first is actually an advantage to the account because it allows you to remove the principal without taxation; but if you’re going to make a distribution, it behooves you to have exact records of what dollars amounts in the account belong to what category. Otherwise, you’re likely to miscalculate your tax liability.

Disadvantage #5: Early Distribution Taxation

Tax-advantaged growth in a Roth IRA is very appealing, but the requirements for distributing that growth aren’t always straightforward. Generally speaking, there are two requirements and BOTH must be met to avoid ordinary income taxes on distributions from a Roth IRA:

Your earliest-existing Roth IRA is at least 5 years old

You are at least age 59.5, disabled, buying your first home ($10,000 limit), or inheriting the Roth IRA.

Disadvantage #6: 10% Penalty Taxation

Note that the above requirements don’t apply to the 10% additional penalty taxation, which is a second level of tax that can occur on a Roth IRA (yes, you can be taxed twice). You’ll incur a 10% additional withdrawal penalty unless you meet at least one of the exceptions. A few of the more common exceptions include:

At least age 59.5

Disabled

$10,000 for a first home

Death of the owner (inherited)

Education expenses

Medical premiums for unemployed

Medical expenses beyond 7.5% AGI

Substantially equal period payments

Example: Billy opened his first Roth IRA in 2020 with a $6,000 contribution, which is now worth $7,000 in 2021. He withdraws the full value of the account to pay for college. Because Billy didn’t have the Roth IRA for 5 years and education expenses aren’t one of the four ordinary income tax exceptions, Billy will pay ordinary income tax on the $1,000 of growth. But he won’t owe the 10% additional penalty tax on the $1,000 of growth because educational expenses are an exception.

2022 Retirement Plan Contribution Limits

This post contains the 2022 contribution limits for 401(k), 403(b), IRA, HSA, FSA, SIMPLE IRA, and SEP IRA plans

Inflation, as measured by the CPI, increased from an average of 1.50% in the early part of 2021 to over 5% in the second half of 2021, which gave the IRS leeway to increase the 2022 limits for some of the most common retirement plans, including 401(k)s, 403(b)s, TSPs, 457(b)s, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs. Notably, the IRS did not increase the Traditional IRA and Roth IRA contribution limits from 2021 to 2022. The announcements were made official by the IRS on November 4, 2021.*

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2022 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $19,500 in 2021 to $20,500 in 2022.

The catch-up contribution for those ages 50 and older remains at $6,500 in 2022, which means employees ages 50 and older can contribute $27,000 in 2022.

2022 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $58,000 in 2021 to $61,000 in 2022.

For those ages 50 and older, if you include the catch-up contribution, the limit is $67,500.

2022 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $19,500 in 2021 to $20,500 in 2022. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older remains at $6,500 in 2022; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2022 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs remain at $6,000 in 2022.

The catch-up provision for those ages 50 and older remains at $1,000 in 2022.

2022 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2022.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2021): $66,000-$76,000

Single (2022): $68,000-$78,000

Married Filing Jointly (2021): $105,000-$125,000

Married Filing Jointly (2022): $109,000-$129,00

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2021: 198,000-$208,000

2022: 204,000-$214,000

2022 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2021): $125,000-$140,000

Single and Head of Household (2022): $129,000-$144,000

Married Filing Jointly (2021): $198,000-$208,000

Married Filing Jointly (2022): $204,000-$214,000

2022 Health Savings Account (HSA) Contribution Limits

The single contribution limits for HSA plans has increased from $3,600 in 2021 to $3,650 in 2022.

The family contribution limits for HSA plans has increased from $7,200 in 2021 to $7,300 in 2022.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2022. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2022 Flexible Spending Account (FSA) Contribution Limits

The 2022 healthcare FSA contribution limit has increased from $2,750 in 2021 to $2,850 in 2022.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2022 SEP IRA Contribution Limits

The SEP IRA limit has increased from $58,000 in 2021 to $61,000 in 2022. Remember, SEP IRA contributions can only be made by the employer.

2022 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA contribution limit has increased from 13,500 in 2021 to $14,000 in 2022.

The SIMPLE 401(k) contribution limit has increased from 13,500 in 2021 to $14,000 in 2022.

*Source: https://www.irs.gov/newsroom/irs-announces-401k-limit-increases-to-20500