Park 64 Capital Blog

Thanks for stopping by and checking out our blog. We post interesting things about finance that we think are of use to the general public, but you should never interpret anything on our website to be financial advice.

2023 Retirement Plan Contribution Limits

This post contains the 2023 contribution limits for 401(k), 403(b), IRA, HSA, FSA, SIMPLE IRA, and SEP IRA plans

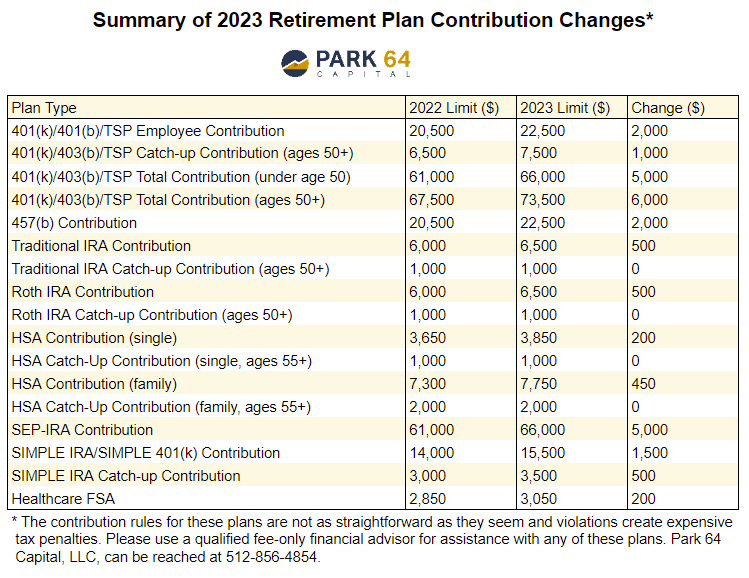

Inflation has been hovering north of 7% for the entirety of 2022, which has given the IRS leeway to increase the limits for some of the most common retirement plans in 2023: 401(k)s, 403(b)s, TSPs, 457(b)s, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs. Unlike 2022, the IRS actually did increase the Traditional IRA and Roth IRA contribution limits in 2023. The announcement for qualified plans was made official by the IRS in Notice 2022-55. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2023 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $20,500 in 2022 to $22,500 in 2023.

The catch-up contribution for those ages 50 and older has increased from $6,500 in 2022 to $7,500 in 2023, which means employees ages 50 and older can contribute up to $30,000 in 2023.

2023 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $61,000 in 2022 to $66,000 in 2023.

For those ages 50 and older, if you include the catch-up contribution, the limit is $73,500.

2023 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $20,500 in 2022 to $22,500 in 2023. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older increased from $6,500 in 2022 to $7,500 in 2023; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2023 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs has increased from $6,000 in 2022 to $6,500 in 2023.

The catch-up provision for those ages 50 and older remains at $1,000 in 2023.

2023 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2023.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2022): $68,000-$78,000

Single (2023): $73,000-$83,000

Married Filing Jointly (2022): $109,000-$129,00

Married Filing Jointly (2023): $116,000-$136,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2022: 204,000-$214,000

2023: 218,000-$228,000

2023 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2022): $129,000-$144,000

Single and Head of Household (2023): $138,000-$153,000

Married Filing Jointly (2022): $204,000-$214,000

Married Filing Jointly (2023): $218,000-$228,000

2023 Health Savings Account (HSA) Contribution Limits

The single contribution limits for HSA plans has increased from $3,650 in 2022 to $3,850 in 2023.

The family contribution limits for HSA plans has increased from $7,300 in 2022 to $7,750 in 2023.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2023. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2023 Flexible Spending Account (FSA) Contribution Limits

The 2023 healthcare FSA contribution limit has increased from $2,850 in 2022 to $3,050 in 2023.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2023 SEP IRA Contribution Limits

The SEP IRA limit has increased from $61,000 in 2022 to $66,000 in 2023. Remember, SEP IRA contributions can only be made by the employer.

2023 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limit has increased from 14,000 in 2022 to $15,500 in 2023.

The SIMPLE IRA catch-up contribution has increased from $3,000 in 2022 to $3,500 in 2023.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

Disadvantages of the Roth IRA

This post discusses the disadvantages of the Roth IRA, a popular retirement savings vehicle.

Since their inception in 1998, Roth IRAs have exploded in popularity. Roth IRAs offer tax-deferred investment growth as well as tax-free distributions, provided you meet certain eligibility requirements. In addition, there are no RMDs on Roth IRA accumulations, so you can hold the account value for life, making it a meaningful part of your estate planning strategy.

While the advantages of a Roth IRA are more easily understood and promoted, the disadvantages are rarely discussed. Not all of these downsides are dealbreakers, but they are high on any financial advisor’s list when thinking about how a Roth IRA fits into the context of the wholistic planning strategy for an individual or family. It’s worth noting upfront that the value of a Roth IRA is unlocked only when you make money in the account. If you lose money over the long-term, you’d have been better off in a taxable brokerage account.

Downsides to the Roth IRA

A Roth IRA has a number of disadvantages:

Contributions are not tax deductible

Contribution and income limitations

No capital loss deductions

Complicated distribution rules

Early distribution taxation

10% Penalty taxation

Disadvantage #1: Contributions are not tax deductible

Roth IRA contributions are not tax deductible, so you won’t reduce your income taxes by funding one. Compared to a Traditional 401(k) contribution at an identical savings target, you’ll have less cashflow due to the income tax burden. The higher marginal tax bracket you’re in, the more taxes you’ll pay upfront by foregoing a Traditional 401(k) for a Roth IRA.

Disadvantage #2: Income Limitations

For 2022, you can only put $6,000 into a Roth IRA (or $7,000 if you’re at least age 50). In addition, Roth IRAs have maximum Modified Adjusted Gross Income (MAGI) limitations, which are discussed here. If you make more than the upper end of the Roth IRA MAGI limit, you can’t contribute to a Roth IRA.

There is a technique called a Backdoor Roth IRA that allows you to circumvent the MAGI limitations; however, it requires the care and skill of a professional to avoid violating the IRS’ Step Transaction Doctrine. The Step Transaction Doctrine basically says if you take a series of steps to get to the same result as you would have gotten with a single transaction, you’ve effectively made the single transaction.

Disadvantage #3: No Capital Loss Deductions

The IRS lets you annually deduct up to $3,000 of net capital losses against your other income for the year, where any excess beyond $3,000 can be carried forward to the next tax year. This deduction is an above-the-line deduction, making it even more valuable. But losses in a Roth IRA do not receive this tax treatment.

There is one exception to this rule. If you close all of your Roth IRAs, you can report any aggregate loss on the total basis as an itemized deduction on Schedule A. I’ve never heard of anyone ever doing this, but it does technically exist.

Disadvantage #4: Complicated Distribution Rules

Distributions from a Roth IRA are assumed to be taken in the following order:

Contributions first

Conversions second

Growth third

Having contributions come out first is actually an advantage to the account because it allows you to remove the principal without taxation; but if you’re going to make a distribution, it behooves you to have exact records of what dollars amounts in the account belong to what category. Otherwise, you’re likely to miscalculate your tax liability.

Disadvantage #5: Early Distribution Taxation

Tax-advantaged growth in a Roth IRA is very appealing, but the requirements for distributing that growth aren’t always straightforward. Generally speaking, there are two requirements and BOTH must be met to avoid ordinary income taxes on distributions from a Roth IRA:

Your earliest-existing Roth IRA is at least 5 years old

You are at least age 59.5, disabled, buying your first home ($10,000 limit), or inheriting the Roth IRA.

Disadvantage #6: 10% Penalty Taxation

Note that the above requirements don’t apply to the 10% additional penalty taxation, which is a second level of tax that can occur on a Roth IRA (yes, you can be taxed twice). You’ll incur a 10% additional withdrawal penalty unless you meet at least one of the exceptions. A few of the more common exceptions include:

At least age 59.5

Disabled

$10,000 for a first home

Death of the owner (inherited)

Education expenses

Medical premiums for unemployed

Medical expenses beyond 7.5% AGI

Substantially equal period payments

Example: Billy opened his first Roth IRA in 2020 with a $6,000 contribution, which is now worth $7,000 in 2021. He withdraws the full value of the account to pay for college. Because Billy didn’t have the Roth IRA for 5 years and education expenses aren’t one of the four ordinary income tax exceptions, Billy will pay ordinary income tax on the $1,000 of growth. But he won’t owe the 10% additional penalty tax on the $1,000 of growth because educational expenses are an exception.

2022 Retirement Plan Contribution Limits

This post contains the 2022 contribution limits for 401(k), 403(b), IRA, HSA, FSA, SIMPLE IRA, and SEP IRA plans

Inflation, as measured by the CPI, increased from an average of 1.50% in the early part of 2021 to over 5% in the second half of 2021, which gave the IRS leeway to increase the 2022 limits for some of the most common retirement plans, including 401(k)s, 403(b)s, TSPs, 457(b)s, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs. Notably, the IRS did not increase the Traditional IRA and Roth IRA contribution limits from 2021 to 2022. The announcements were made official by the IRS on November 4, 2021.*

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2022 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $19,500 in 2021 to $20,500 in 2022.

The catch-up contribution for those ages 50 and older remains at $6,500 in 2022, which means employees ages 50 and older can contribute $27,000 in 2022.

2022 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $58,000 in 2021 to $61,000 in 2022.

For those ages 50 and older, if you include the catch-up contribution, the limit is $67,500.

2022 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $19,500 in 2021 to $20,500 in 2022. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older remains at $6,500 in 2022; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2022 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs remain at $6,000 in 2022.

The catch-up provision for those ages 50 and older remains at $1,000 in 2022.

2022 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2022.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2021): $66,000-$76,000

Single (2022): $68,000-$78,000

Married Filing Jointly (2021): $105,000-$125,000

Married Filing Jointly (2022): $109,000-$129,00

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2021: 198,000-$208,000

2022: 204,000-$214,000

2022 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2021): $125,000-$140,000

Single and Head of Household (2022): $129,000-$144,000

Married Filing Jointly (2021): $198,000-$208,000

Married Filing Jointly (2022): $204,000-$214,000

2022 Health Savings Account (HSA) Contribution Limits

The single contribution limits for HSA plans has increased from $3,600 in 2021 to $3,650 in 2022.

The family contribution limits for HSA plans has increased from $7,200 in 2021 to $7,300 in 2022.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2022. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2022 Flexible Spending Account (FSA) Contribution Limits

The 2022 healthcare FSA contribution limit has increased from $2,750 in 2021 to $2,850 in 2022.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2022 SEP IRA Contribution Limits

The SEP IRA limit has increased from $58,000 in 2021 to $61,000 in 2022. Remember, SEP IRA contributions can only be made by the employer.

2022 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA contribution limit has increased from 13,500 in 2021 to $14,000 in 2022.

The SIMPLE 401(k) contribution limit has increased from 13,500 in 2021 to $14,000 in 2022.

*Source: https://www.irs.gov/newsroom/irs-announces-401k-limit-increases-to-20500