Kelly Betting: How Much to Invest in a Stock

Sizing stock market positions is a difficult challenge. It’s arguably the hardest thing an investor has to do after selecting the investment itself. You might be surprised to learn that there is a theoretical way to optimize an investment allocation, called the Kelly Betting Criterion. The Kelly Betting Criterion was created by a brilliant scientist in mid 20th century named John Kelly. Despite it’s convincing proof, Kelly Betting has some limitations and therefore other considerations must be made when sizing up stock allocations. Let’s dig into the how and why behind this neat little formula.

What is a Kelly Bet?

A Kelly Bet is a mathematical formula used to size investments for the most optimal growth rates as the number of investments approaches infinity. This growth rate is a function of the fraction of wealth invested, the probability of winning, and the odds at stake. For example, consider a wager with a 2:1 payout where you win 60% of the time. Your expected gain on a wager requiring $10 to enter is $8 (2 x $10 x 60% - 1 x $10 x 40%). A casino would never offer this game to you because they’d lose $8 each time on average. That’s easy to understand, but what’s harder to determine is how much of your life savings you’d put into this same wager if you could repeat it ad nauseum.

You know the above wager has positive expected value, but you also know you’ll lose some of the time. For example, if you bet your entire life savings on a single wager and lose, you go broke. Similarly, too small of a bet is counterproductive to making wealth fast enough; this is would be similar to holding most of your wealth in cash.

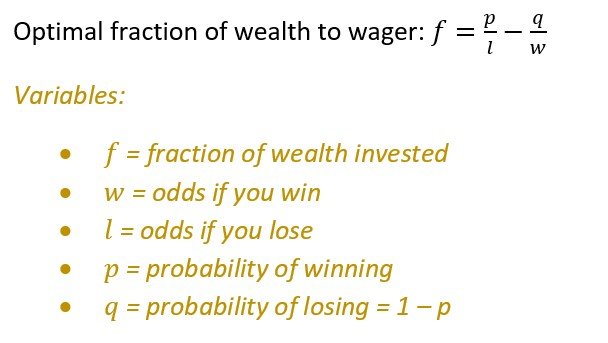

Now let’s consider an investment with the same wager as described above but under the assumption you have a $1M total portfolio. How much should you invest of that $1M to grow your portfolio optimally? We solve this using the following equation:

Plugging in the numbers from our example, we can see that betting $400,000, or 40% of our wealth, is the solution. In other words, f = 0.60 / 1 - 0.40 / 2 = .40 = 40%.

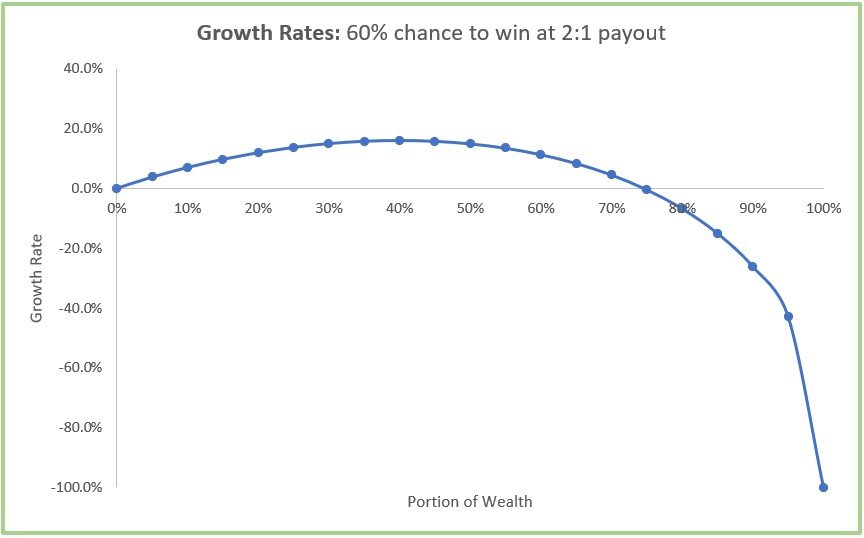

The growth rates over the possible range of wealth percentage wagers is shown graphically below. Interestingly enough, there is an inflection point at 75%, where wagering that amount or higher gives you a negative growth rate (this is true despite having a positive expected value of $0.80/dollar, as mentioned earlier. You can also see that wagering 100% of your wealth on a single investment leads to a growth rate of -100%; this should make sense. Even if you’re right about the first 100 investments, it only takes one to ruin you in this particular case.

The Kelly Criterion has meaningful consequences as it relates to investment. Notably, even if we think we have an investment with a 2:1 payout and a 60% chance of winning, we still can’t safely bet the farm on it because it’s not the most optimal way to grow our portfolio. We also know that we have to diversify because it’s suboptimal to excessively allocate to a single position.

Why the Kelly Bet Might Not Even Matter

I would contend that the Kelly Betting Criterion is a useful tool to humble one’s confidence and codify the need for diversification (which is typically justified using Modern Portfolio Theory). However, the Kelly Betting Criterion does have a number of limitations that prevent it from being used with any sort of nontrivial level of precision:

There’s no way to know the numerical probability of winning with an investment. The best one can do is thoroughly research to make a yes or no decision.

Investing odds aren’t clear. For the most part, quality stocks don’t go to zero nor can they grow forever. There are discounted cash flow methods I use to create upside vs. downside levels, but there are still a great number of uncertainties in investment that make it impossible to know if something is 4:2 or 4:1.25, for example; the difference would change an allocation meaningfully.

Kelly Betting assumes infinite repeats of a bet; in reality, an investor has a more limited time frame to grow their wealth.

Allocation is tricky because it remains an area of art, science, and experience.; the Kelly Bet criterion is just one tool in the toolbox of understanding. Allocation also requires confidence, humility, and discipline. Investments need to be scaled in proportion to goals, timelines, confidence, risk capacity, and a host of other factors. ETFs can be held in greater proportions than stocks, of course, but it behooves the investor to know the components held in the ETF to ensure the underlying securities are of proper ilk to meet the desired growth rate objectives.

If you’re interested, I’ve included a proof of the Kelly Bet below. It does require elementary calculus to understand fully.