Why You Probably Need Private Disability Insurance

In my first 6 months as a full-time financial planner, I’ve learned that people don’t want to pay for private disability insurance. And who could blame them: the longer you own a disability insurance policy, the less benefits it pays. Compared to employer-provided group disability coverage, private disability insurance has significant premium costs. There is strong emotion tied to continuously sinking premiums into a policy that is designed to pay you less and less as you get older. In many ways, a disability insurance policy is like a depreciating lottery that you never want to win. But does that mean that purchasing private disability insurance is a bad deal? No. For most people, private disability insurance is the number one way to protect against lost income yet is often overshadowed by life insurance sales.

It’s hard for people to see the value of disability insurance because:

It’s a limited use indemnity product, meaning that it’s designed to pay you for a defined portion of lost wages and only while disabled.

It’s expected value is negative, and you only “win” if you go on claim. This is true for all insurance, but it still bears mentioning.

Compared to life insurance, where you’re either dead or you aren’t dead, the definition of disability can potentially be contested by the insurance company.

Regardless, most people probably need private disability insurance during their productive working years, typically from their early twenties to retirement. Let’s look at these quick facts before jumping into a deeper discussion about why disability insurance is so critical:

Arthritis & other musculoskeletal diseases, heart disease, cancer, mental health disorders, diabetes and nervous system disorders are the leading causes of disability in the U.S.

Disability, on average, is almost 3 times as likely as death during your productive working years.

Disability insurance is more valuable when you’re young and becomes less valuable as you age.

Employer-provided group disability insurance policies aren’t portable and typically only cover your career occupation for two years of disability, among other shortcomings beyond the scope of this post. You should be very cautious about trusting your employer’s group policy to protect your income to retirement unless you and your advisor already understand all the fine print.

How Private Disability Insurance Works

Private disability Insurance charges you a level monthly or annual premium and will pay you a tax-free monthly benefit for a predetermined time, typically until age 65, if you become disabled and unable to work. Benefits are typically 60-70% of your current income. Depending on how the disability insurance policy is structured, you may be eligible for partial or residual disability benefits if you can return to work but only in a limited capacity. If you don’t become disabled during the policy’s lifetime, you don’t get your money back.

Private disability insurance is important because it:

Protects you and your family against lost wages by providing tax-free income.

Stays with you no matter where you work (i.e. portable).

Fills in coverage exceptions found in employer-provided group disability policies.

Overcomes the draconian qualifications necessary to qualify for Social Security Disability Insurance.

Why Clients Forego Private Disability Insurance

Of all the financial planning recommendations I make, I get the most pushback on disability insurance. The recommendation itself brings mindfulness to all clients, which is always a benefit; this has resulted in some clients having hard talks with family about what happens in a financial situation involving disability, and sometimes clients will come back with a plan that includes extended family care and support, negating the need for insurance. However, not everyone has such circumstances available and perhaps some overestimate their family’s ability to provide care altogether; therefore, most people still need to purchase private disability insurance.

The biggest reasons people are hesitant to buy private disability insurance are:

Cost: “That’s just too expensive!”

Competing Goals: “I’d rather just add to my retirement savings instead.”

Myopia: “It won’t happen to me.”

Self-Insurance: “My family will take care of me.”

Gender: Women pay the most for disability insurance, typically 2-3x the premium rate that males pay.

Why Women Pay More for Private Disability Insurance

If you’re curious, the leading reasons women pay so much more for disability insurance include:

On average, women live longer than men, so they get paid disability benefits for a longer period of time.*

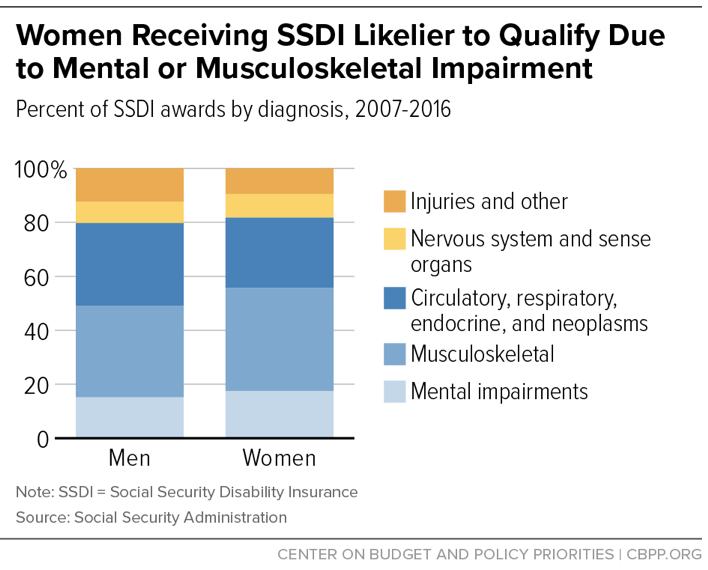

Women suffer more non-life threatening health conditions as they age. In particular, musculoskeletal disorders like arthritis and rheumatism are the most common disabilities affecting American women. Mental impairments are higher in women than men too although many disability insurance policies exclude benefits for those after two years.

Women are more likely to go to the doctor when they’re sick while many men will try to “tough it out.”

Valuing Disability Insurance: Example

Valuing disability insurance is tough for clients because humans inherently struggle to value risk correctly, particularly when it comes to long-term perils like disease. Emotions run high during the disability insurance suitability process, so it’s especially important to drill into the numbers to understand and justify recommendations.

Imagine the following scenario for yourself:

Client age: 35

Monthly premium: $250

Monthly tax-free benefit: $4,000

Benefits Duration: Continue until age 65

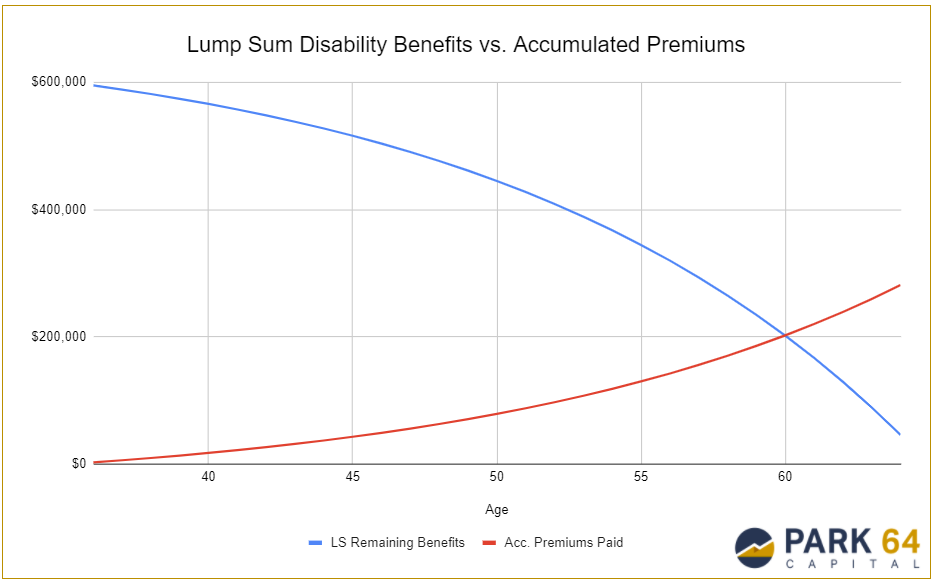

Each year, you pay $3,000 in premiums for $48,000 of potential annual tax-free benefits. If you became disabled from age 36 until age 65, you’d receive total payments of about $1.40M. Using an interest rate of 7%, that’s equivalent to a lump sum of $595,000. (NOTE: Disability insurance policies don’t actually pay lump sums, but it’s helpful to quantify the equivalence for comparison purposes).

Now imagine you’re age 60 and have paid premiums for the last 25 years but never became disabled. What’s the sunken cost? If you had put those premiums into a portfolio earning 7% interest, they’d be worth about $200,000. Coincidentally, the remaining lump sum disability benefits are now worth about $200,000 as well; in other words, even if you become totally disabled at age 60, the best you could do is breakeven on the policy. You can see the crossover point between accumulated premiums (red line) versus lump sum benefits if disabled (blue line) in the graph below.

How do I interpret the above graph? The potential future disability benefits (blue line) decrease with age while the accumulated premiums (red line) increase with age. In other words, you’re continuously sinking premiums into a depreciating benefit base. This is why disability insurance often feels like a waste of money.

Does the crossover point mean that you lost value by not foregoing the policy premiums earlier to reinvest them elsewhere? No. Accumulated premiums are interesting to look at but have already been spent for the value received. In other words, each year those premiums were spent, your income was protected. And if you didn’t protect that income, future living costs, retirement savings, etc. could easily be thrown off course.

Does the crossover point mean that there is no point in owning disability insurance beyond age 60 in this particular example? Not necessarily. While those who are diligent about saving throughout their career can usually cancel their private policies before age 60, it’s always on a case-by-case basis. If there is a material risk to being without income prior to retirement, private disability insurance is still necessary; this is an area where a qualified financial advisor can help you make better decisions.

How to Think About Disability Insurance Correctly

Once it’s been identified that disability insurance is necessary, valuation should be considered in the absence of emotion, which is easier said than done. Passing up on disability insurance is likely a big mistake. Here are useful things to keep in mind if you’re still on the fence about purchasing a private disability insurance policy:

1. You’re in trouble if you can’t work. If you’re not ready to retire yet, you need income protection. America is a harsh place if you can’t contribute to her economy, and overreliance on others to take care of you comes with many risks of its own, including being left out in the cold.

2. Insurance is a losing proposition on average. Insurance involves pooling the risks of the many to pay for the few. The average purchaser will trade money for peace of mind and nothing more. Disability insurance is no exception, but that doesn’t make it a bad deal.

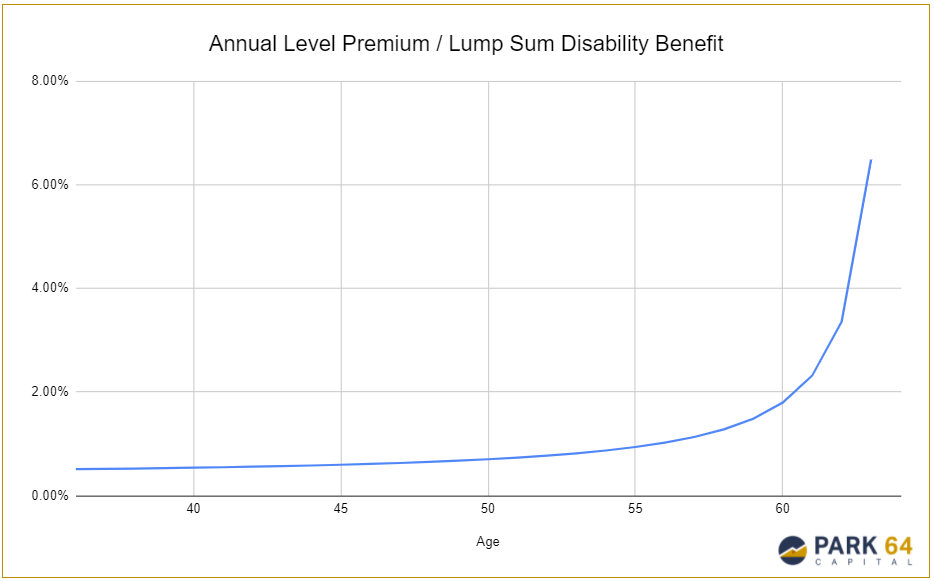

3. Consider each year independently. Focus on each year’s premium as its own individual decision and compare it to the lump sum benefit equivalence. Graphically, you’ll see the ratio of premium to benefits nominally increase until about age 50, at which point the ratio increases more dramatically. The increase is due to the lump sum of future benefits decreasing rapidly towards the policy end date, typically age 65.

4. Remember, you can cancel the policy. I’ve seen clients get caught in a mental trap where they think they need to renew their disability policy year after year, but that isn’t true. Once you’re retirement ready, a disability insurance policy is no longer necessary.

5. Forget about premiums already spent. Premiums from prior years provided value by covering your lost wages if you had become disabled. They weren’t a waste of money, so don’t feel bad about it.

6. Your employer’s disability insurance is most likely inadequate. Employer-provided group disability insurance plans are as cheap as they come, and they don’t stay with you if you leave the company. Private disability insurance is the best way to supplement that coverage gap!

7. Working with a financial advisor is extremely important. Navigating private disability policies within the scope of a comprehensive financial plan is the best way to find the correct coverage amount from the right insurance carrier with the ideal riders at the best price. Going in guessing is the best way to waste money or find yourself missing important protection features.

Why Working with A Fiduciary Like Park 64 Capital Matters

As a fee-only financial planner held to a fiduciary standard, I don’t make any additional compensation when my clients purchase a private disability insurance policy. This removes conflicts of interest from my firm, which maintains the integrity of the professional relationship. Nevertheless, Park 64 Capital helps you:

Determine if you need private private disability coverage.

Figure out how much monthly benefit you need.

Identify which enhancement riders you should add to your policy.

Find an unaffiliated and reputable insurance agent.

Review all disability insurance quotes prior to purchase.

Manages all other aspects of your comprehensive financial plan to make sure that everything is in sync.

Stay safe out there!

*Source: https://www.cbpp.org/research/social-security/women-and-disability-insurance-five-facts-you-should-know